Back on track: Will employers fund allied healthcare?

The long-term impact of the coronavirus pandemic will not be known for months, or possibly years, but its immediate aftermath is being felt at many levels. Unemployment in Canada was at a staggering 13% in April, 5.5-million Canadians out of work or with substantially reduced hours.[1] More than 80% of small businesses have been negatively affected by the crisis, with many worried about their long-term viability.[2] Employment rates plunged in the second quarter but are expected to improve somewhat by the end of the year.[3]

Among these businesses are many allied healthcare providers, including chiropractors, physiotherapists, psychologists, naturopaths, speech therapists and optometrists. Will patients be back? Will employers still provide coverage? How will we work through physical contact limitations? Can we rebuild with streamlined practices for a new world of healthcare delivery?

Employee benefits continue

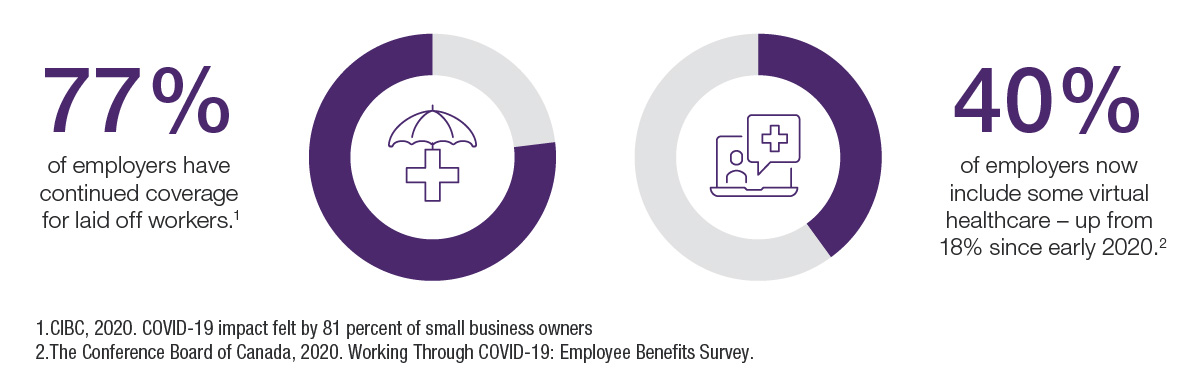

A recent survey by The Conference Board of Canada offers some encouraging news for healthcare professionals whose patients rely on private coverage.

The majority of employers (68%) do not plan to make any changes to their benefits offerings; in fact, in some industries, coverage is likely to increase in coming months[4]

Another bright spot is a large number of unemployed workers still have benefits, with 77% of employers reporting ongoing coverage for most or all of their laid-off employees.[4]

At least for Canadians who previously relied on private payors, cost is not likely to be a barrier to seeking treatment from allied practitioners. Perceived risk, however, poses a more significant problem.

Resuming appointments for allied healthcare

Despite continuing benefits support, research released in May revealed that patients will not likely be rushing back to their pre-pandemic healthcare habits. Results from the survey conducted in May revealed that about one-third (34%) of Canadians said they would attend in-person physiotherapy appointments, and for massage therapy and chiropractic treatment, those numbers are slightly lower, at 29% and 28% respectively.[5]

However, July transaction data from TELUS Health’s eClaims service tells a different story. Internal data is demonstrating a relatively quick bounce back with eClaims transactions now (as of July 20) trending at 97% of predicted normal volume for this time of year.

The shift to virtual delivery

An interesting outcome of the COVID-19 lock-down is the increased focus on virtual healthcare by practitioners, patients and employers. In fact, the percentage of employers including virtual care in their benefits offering more than doubled from about 18% before the pandemic to 40% by late April, with an additional 15% considering it.[6]

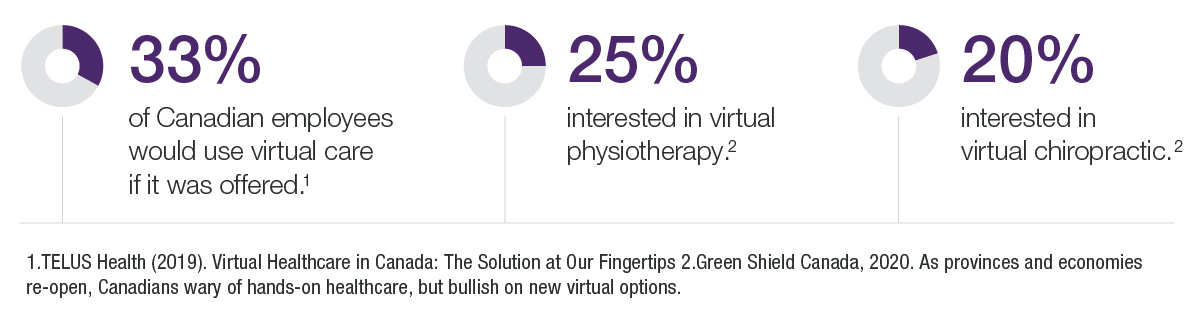

Employees are eager to give virtual care a try, with two-thirds of Canadians saying they would use online healthcare if it were part of their employee benefits offering. [6] Nearly 80% of patients who try virtual care report the quality of the visit is the same as an in-person appointment.[7]

For mental health support, about four in ten (43%) Canadians would seek virtual care[5]; interestingly, that number jumps to 63% among those in the 18 to 34 age bracket.[5] About one-quarter of respondents are interested in exploring virtual physiotherapy and one-fifth in virtual chiropractic treatment.[5]

With this growing interest in new ways to access treatment and with employers continuing to support their workers’ access to care, through benefits plans, how should practitioners be adjusting their business ahead of reopening?

Rethinking the practice and the business of care

Safety, of course, comes first, and provincial health authorities are working with professional governing bodies to define how in-office visits can be conducted safely. The majority of patients are expecting full Personal Protective Equipment (PPE) protocols, and will want a clear explanation of how physical safety will work in your facility.[3] Done well, this communication creates an opportunity to invest in positive patient experiences during an uncertain period.

In addition to ensuring the safety of physical office visits, allied professionals should consider offering a virtual treatment option. There are many platforms that facilitate virtual care including a basic phone call, video conferencing, text chat and even email exchanges. Choose the platforms that are the most comfortable and accessible for your practice and for the types of patients you typically serve.

For many patients, your virtual office may be their first non-physical treatment experience. You can make the virtual appointment more comfortable and productive by helping your patients prepare.

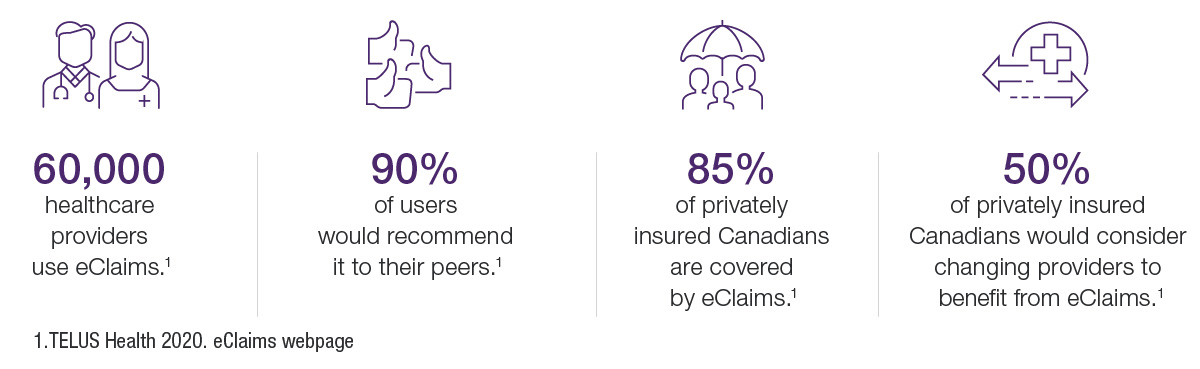

Another area where you can streamline your operations is in how you handle billing. More than 60,000 healthcare providers[8] are already using eClaims, a free direct billing service that lets you easily submit claims directly to insurers on your patients’ behalf. With more than 85% of privately insured Canadians covered by eClaims, it’s a great tool to help attract and keep patients and reduce your credit card fees. In fact, 90% of Canadian allied health professionals who use eClaims would recommend it to their peers.8

For patients who may be watching finances, direct billing keeps a little more cash in their pockets since they will need to pay only the portion of the treatment fee that is not covered by their benefits.

Many insurers accept eClaims, and half of Canadians say they would consider changing healthcare providers to benefit from direct billing.[9] Plus, eClaims works with virtual consultations as easily as for in-person. Watch this webinar to learn more about submitting claims for virtual care visits.

Whatever your back-to-business plan looks like, be sure you reach out to your patients via email or even telephone to let them know when you will be taking appointments, and take some time to make sure your website, Facebook page and social media feeds are updated as well.

Looking for more return-to-work tips?

Watch this webinar, presented by our friends at TELUS Business. Download this return to work playbook from our friends at Medisys supported by TELUS Health.

Watch this webinar on 3 marketing essentials to restart your practice, presented by the TELUS Health eClaims team.

While it’s unlikely we will experience healthcare quite the same way as before the pandemic, allied practitioners have an opportunity to help accelerate their practice recovery by adopting new delivery models, such as virtual care, and by finding new tools that can streamline administration, reduce costs and improve patient experience.

At TELUS Health we’re privileged to serve the thousands of dedicated healthcare professionals who care for Canadians. To learn more about how we can help you recover and rebuild, visit our website.

[1] Statistics Canada, May 8, 2020. Labour Force Survey, April 2020

[2] CIBC, 2020. COVID-19 impact felt by 81 percent of small business owners

[3] Office of the Parliamentary Budget Officer, April 30, 2020. COVID-19 Pandemic and Oil Price Shocks

[4] The Conference Board of Canada, 2020. Working Through COVID-19: Employee Benefits Survey

[5] Green Shield Canada, 2020. As provinces and economies re-open, Canadians wary of hands-on healthcare, but bullish on new virtual options

[6] TELUS Health (2019). Virtual Healthcare in Canada: The Solution at Our Fingertips

[7] Canada Health Infoway, 2017. Digital Health Myths

[8] TELUS Health, 2020. eClaims webpage

[9] TELUS Health, 2020. Reduce paper billing and increase customer loyalty